ISLAMIC CAPITAL MARKET: MALAYSIA INSTRUMENTS

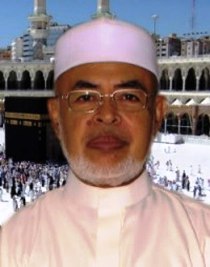

Muhammad Yusri bin Yusof @ Salleh

Lecturer

Islamic Business Transaction

Centre for Islamic Thought and Understanding

Universiti Teknologi MARA Perak

Seri Iskandar Campus

There are 2 categories of Islamic capital market instruments:

1.2.1. First category: Islamic capital market instruments, structured using the principles of Islamic Muamalat.

Securities issued by government

The first securities in Islamic capital market is Government Islamic Investments (GIIs), issued in1983 using the principle of Qard Hasan. This security can be defined as free interest securities issued by the government to meet the need of the Islamic Bank Liquid Reserves. This certificate is issued under the provisions of the Government Investment Act 1983. Investor will not be paid interest as any other government securities but the investor will receive hibah for holding securities. Hibah given in the 1983-1995 period is between 4% and 8.15% per year.

The second security in Islamic capital market is International Islamic Bonds which is managed by Malaysia Global Sukuk Inc. This security is also known as Sukuk Bond by using Ijarah principles. Sukuk Bond has published by USD 600 million. There are four steps involve in issuing this bond:

I. In certain government agencies to sell property owned Malaysia Global Sukuk Inc, with the agreement that the government would buy it again at the end of the maturity of the bonds.

II. Property purchased by Malaysia Global Sukuk Inc, will be leased back to government with the specified form of payment.

III. The Malaysia Global Sukuk Inc will make the property as securities backed Sukuk issued to the rented property. Sukuk will be matured until 5 years.

IV. When the bond reaches maturity date, Malaysia Global Sukuk Incwill sell back the property to government with the original sales price.

Islamic Corporate Bond

Corporate bond can be defined as a promissory note which involves long-term issued by a company that promised to pay the holder the interest each year until reach maturity. In other words the bond is a form of loan production to obtain funds in a certain period. Within this manufacturer agreed to pay interest that have been assigned to the bond holders and to repay all amounts borrowed at the end of the period. Islamic Corporate Bond is a bond structure based on syariah principles such as Qard Hasan, Mudarabah, Murabahah, Ijarah and some principles more. Sales based on Bay’ Al-Dayn concepts. The purpose is to raise capital to finance a project.

Islamic Benchmark Bond

Target for Islamic Benchmark Bond is the benchmark for the corporate bonds that would be published. Bond is structured based on Murabahah principles (an asset sale and purchased contracts where the price includes a profit margin agreed by the buyers and sellers).

Khazanah Nasional Berhad will manage is issuance of Islamic Benchmark Bond. Thus this bond called as “Bon Murabahah Khazanah”. The Islamic Benchmark Bond must be free from any risk. Treasury will sell its assets passed to syariah investor cash and buy it back with a higher price in deferred payment. Asset purchase price back in Murabahah has been determined earlier by the treasury while the cash price is determined through the tender process bids using the Bay’Muzayadah principles.

Islamic Unit Trust

An investments scheme which collect money from a large number of investors who share a same financial objectives. Accumulated funds will be managed and invested by a group of professional fund managers. Investments made in various types of securities such as profiles of stocks, bonds and money market instruments. Only allowed to invest in instruments approved by the Securities Commission Syariah Advisory Council. For investment made in the banking industry, unit trust manager only allowed to invest in Islamic banking and Islamic money market only.

Islamic Stock broking

Broker is an individual or firm that acts as an intermediary between sellers and buyers. Brokers have expertise in terms of market about demand and supply and skilled in predicting market trends. Stock brokerage investment services performed by making islam the investment shares certified as passed by the Securities Commission Syariah Advisory Council.

Islamic Venture Capital

Acording to John Black, Islamic Venture Capital can be defined as capital invested by owners who are willing in the new business where the risk of loss is high. Meanwhile, Hornby defined it as capital business which invested money in new business, especially for high risk. Islamic Venture Capital has a similar definition with the definition given, the only distinguish is the investment principles and implemented in venture capital financing is based on Islamic principles. Islamic Venture Capital in Malaysia using some principles of syariah and Ijarah ,Mudarabah, Mushakarah mutanaqisah and several contracts approved as syariah option purchase, stock option sales and loans in Islam.

Mudarabah Cagamas Bond

Issued by Cagamas Berhad in collaboration between Bank Negara Malaysia and Bank Islam Malaysia Berhad. Purpose of this bond is to develop mortgage markets in the second stage of Islam. This bond contains two elements:-

i. Purchase of Islamic housing debts by Cagamas from institutions that provide financing in Islam. Purchase is done based on the principles of Bay’Dayn.

ii. Production in Mudarabah bonds to finance this purchase, with the securitization of home loans in Islam through these schemes will enable financial institutions to offer financing facilities continuously seek refinancing of Cagamas Berhad and thus they could provide housing facilities to customers with more reasonable price.

Second Category: Conventional Capital Market Decided by the Syariah Advisory Council of the Securities Commission in Line With the Requirements of Syariah.

Shares

Stock is a security issued by a company during its formation or whether the company requires additional capital to expand its activities. Proof of ownership of shares is a holder of the company. As a proof of ownership, the company according to the company act 1965 to issue stock certificate to the owner. Stock certificate will contain the seal of the company, date issued, name and address of the owner and number of holdings. Shares can be sold by the holder in the secondary market to obtain funds immediately or to change the position or portfolio investment in the corporate sector.

Call warrant

Defined as a right, but not the obligation to purchase the quantity of an asset such as shares within certain prices and certain time. It can be defined as the right to subscribe shares available. Call warrant has two main features, first a call warrant is issued to a company underlying assets such as shares of a company. Second it has the right to use the fixed price at the time the warrant was issued. This price can be used when the owner of warrants to purchase shares of the underlying.

Transferable subscription rights (TSR)

Is a document that gives the rights, but not the obligation to the holder to purchased new ordinary shares at a set price within a certain times. TSR will not be worth when it exceeds the prescribed period. In other countries it is better known as a warrant. Warrants price will fluctuate according to the price of an issue. Warrant typically have two year validity period, but sometimes can be longer than that/ in a period not specified. TSR published by the publishing company shares. TSR publications among the main factors when it is purchased, the company will increase capital and can be used for financing development company. TSR owners do not have voting rights and do not receive any dividend/interest.

Securitization

Asset securitization is a process of issuance of securities by selling financial assets that are identified as fundamental to a third party who seeks to melt the financial assets as alternative measures to the loan directly from a financial institution owned by the company to securities market to be sold to investors. In Malaysia, financial assets that have future cash flows a company will be sold to a third party, known as Special Purpose Vehicle (SPV) in cash. To pay for the purchase of assets, the SPV will issue a debt securities based on valuation of assets purchased. The investors will get returns back through future cash that will be managed by the SPV.

Security of borrowing loan (SBL)

Borrowing is a security in the capital market activities involving the borrower and lender to meet temporary needs and solve business sale and purchase of shares in accordance with their rules and guidelines set. Activities carried out within this particular period when the promised end, the borrower must return the borrowed securities back it is either the original securities or other securities of the same type and amount. Lenders will also charge a deposit and payment services to borrowers as one of the conditions of the contract

Operating leases and finance leases.

The lease is a contract between the owners of an asset to customers who specify that the owner or lessor to provide certain assets to customers or also known as a holder for use tax and as measure lessor will receive consideration for periodic rental payments stipulated time period of the contract was signed. Leases can be dividing into two leases which are operating leases and finance leases.

First, an operating lease is the lessor will provide assets or facilities with full supporting facilities, includes the provision of technical staff for management and maintenance of these assets. As a measure, the holder will agree to pay taxes on rental throughout the lease period. The lessor will generally lease these assets for a certain period of time and take it again after this period ended and re-lease to another customer or customers may be the same. This type of lease can be cancelled at any time by giving prior notice.

Second, the financial lease customers will first choose which assets may need and request the lessor to buy from suppliers. Assets purchased will be delivered to the holders of tax. Holder agrees to pay the tax then the monthly rental rates stipulated. Holders also agreed to maintain tax assets and purchase adequate insurance against such assets. This type of lease cannot be revoked before the term ends. When the leases end, the holder can choose to return the tax return assets to the lessor or the purchase price or market agents to be sold to third parties.

Preferences share

Preference shares are shares that do not give the holder the right to vote at the general meeting or any right to participate beyond what has been stated that the amount of any distribution company whether by dividend or redemption, liquidation or otherwise. Instrument is called preference shares because the holder has a priority in terms of distribution of dividends than common shareholders. This means that the distribution of dividends will be distributed in advance to handle than ordinary shareholders. The same situation occurred in the distribution of the assets of the company when the company dissolved.

Crude Palm Oil Future Contract (CPO)

Futures contract is a contract transaction involving two parties who agree to buy and sell a commodity or currency at a time will come according to conditions agreed with. Futures contract palm oil can be defined as an agreement to purchase and exchange transactions to sell certain quantities of crude palm oil in the market in the actual quantity of a standard, on the date and place of future delivery in the set. Contract is intended to facilitate those involved in the business of crude palm oil business in managing risk more efficiently and effectively, especially against the risk of price changes.

CONCLUSION

In conclusion, the structuring of Islamic capital market instrument based on the principles of jurisprudence Muamalat produce instrument that could give options to investors and thus be able to add funds to development projects and companies activities conducted by whether private or government. This action will increase the investor who is interested to invest in an Islamic Capital Market instruments based on syariah principles, especially for Islamic investors.

SENARAI GRADUAN SESI 2016

-

*SENARAI PELAJAR YANG AKAN DIIJAZAHKAN DI MAJLIS PENGIJAZAHAN DARUSSYIFA'

PADA 25-DIS-2016 (AHAD).*

Kepada pelajar Pengubatan Islam Darussyifa' Bangi Kumpu...

7 years ago